Dear investors! The Consulate General of the Kyrgyz Republic in Dubai and the Northern Emirates, in order to monitor investment attractiveness, has the honor to publish Tax incentives in the Kyrgyz Republic to attract investors.

Dear investors!

The Consulate General of the Kyrgyz Republic in Dubai and the Northern Emirates, in order to monitor investment attractiveness, has the honor to publish Tax incentives in the Kyrgyz Republic to attract investors.

Kyrgyzstan has a list of preferential types of industrial activities subject to preferential taxation in more than 30 localities of the country

The list includes industrial activities in such areas as:

- light and food industry;

- electric power industry;

- processing of agricultural products;

- assembly of production;

- all types of industrial production based on innovative technologies;

- any export-oriented production.

There is also an exemption from property tax, land tax, income tax and sales tax for newly created enterprises whose activities are associated with preferential industries.

In addition, the income tax rate is set at 5%.

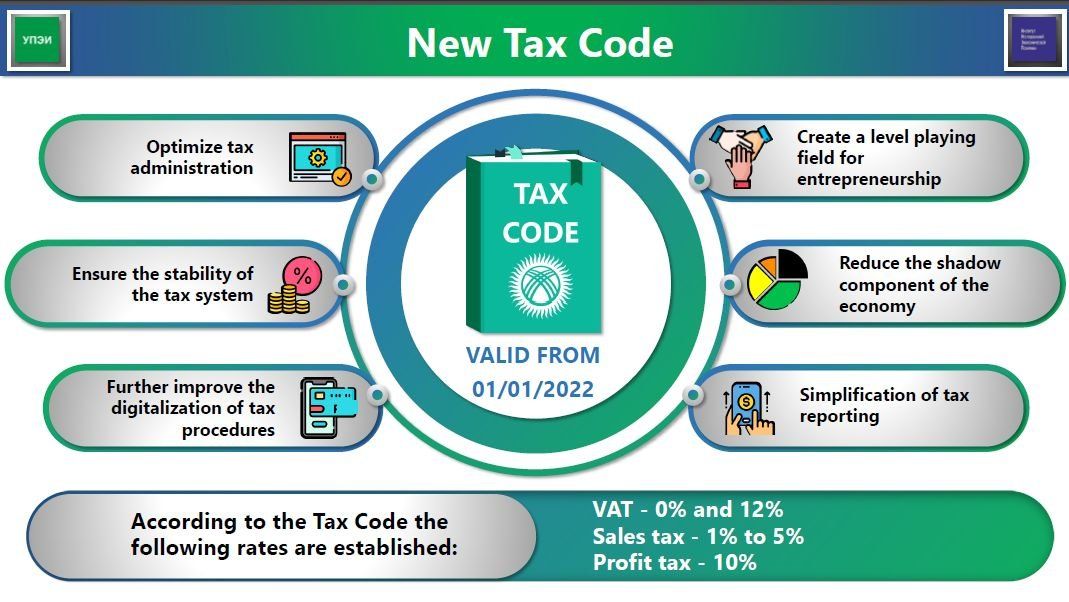

Since the beginning of 2022, a new Tax Code has been in force in Kyrgyzstan, the purpose of which is to optimize tax administration, ensure the stability of the tax system, further improve the digitalization of tax procedures, create equal playing conditions for entrepreneurship,

reduce the shadow component of the economy and simplify tax reporting.

According to the Tax Code , the following rates are set:

- VAT - 0% and 12%;

- Sales tax - from 1% to 5%;

- Income tax - 10%.

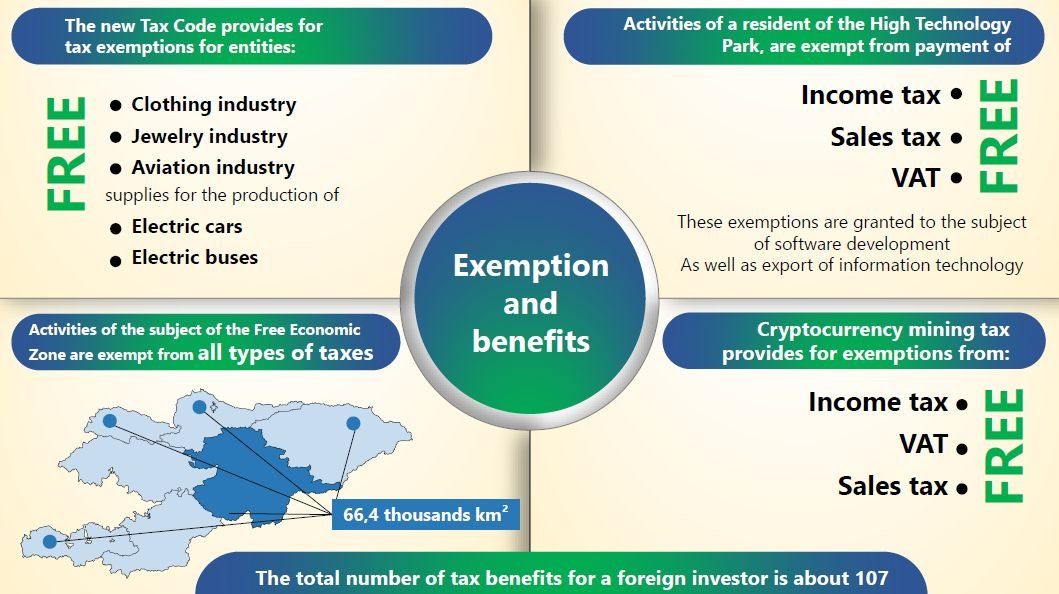

The new Tax Code provides for:

- tax benefits for subjects of the clothing, jewelry and aviation industries, as well as VAT on supplies for the production of electric vehicles and electric buses;

- the activity of a resident of the Hi-Tech Park is exempt from income tax, sales tax, value added tax. These exceptions are granted to the object of software development, as well as the export of information technology;

- the activity of the subject of the Free Economic Zone is exempt from all types of taxes;

- the cryptocurrency mining tax provides for exemption from income tax, value added tax and

The total number of tax benefits for a foreign investor is about 107 benefits.